South Korea’s Naval Export Boom

South Korean shipbuilding; Japan's missile program; hypersonic missiles

Hub Story: South Korea’s Naval Export Boom

Spoke Story: US Supports Japanese Hypersonic Program

Alliance Insights: Key Articles This Week

Hub Story: South Korea’s Naval Export Boom

The USNS Wally Schirra (T-AKE-8) completed a seven-month overhaul at Hanwha Ocean’s shipyard in South Korea, marking the first large-scale maintenance of a US naval vessel in the country as part of efforts to expand repair options in the Indo-Pacific. The successful maintenance demonstrated South Korea’s growing role in US naval logistics, with Hanwha Ocean showcasing its ability to reverse engineer components and handle complex repairs. This effort aligns with broader US initiatives to develop ship maintenance hubs across the region, including in India, the Philippines, and Japan, to enhance operational readiness and reduce downtime. South Korean shipbuilding is a critical allied capability that Washington has only recently begun to leverage.

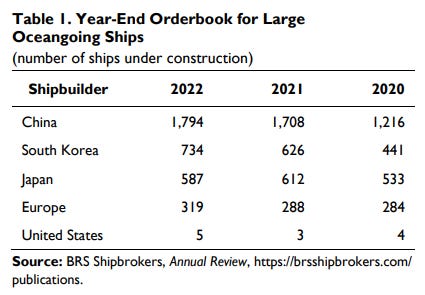

The decline of American shipbuilding has been steep, stagnating at around five ships per year for decades, leaving the industry a shadow of its former self. The consolidation of the shipbuilding industrial base combined with other government restrictions has resulted in increased costs. Meanwhile, Asian nations have steamed ahead on shipbuilding. The three largest shipbuilding firms in China, Korea, and Japan (nine firms in total) account for 75 percent of world shipbuilding capacity.

South Korea in particular has played a leading role in supporting allied shipbuilding needs.

South Korea has become the primary supplier of naval vessels for the Philippine Navy, playing a central role in its modernization efforts under the Revised Armed Forces of the Philippines Modernization Program (RAFPMP). By 2028, the Philippine Navy is expected to operate at least 12 South Korean-built ships, including frigates, corvettes, and offshore patrol vessels, as Manila shifts toward territorial defense operations amid rising regional tensions. This deepening defense relationship reflects South Korea’s cost-effective shipbuilding capabilities and strategic proximity, allowing the Philippines to rapidly expand its maritime forces while balancing budget constraints and operational demands.

Seoul is also courting NATO countries as these nations look to increase defense spending. South Korea is actively positioning itself as a key defense supplier for Canada, offering advanced military equipment, including KSS-III submarines, as an alternative to U.S. defense systems amid growing concerns over American reliability. With a proven track record of supplying NATO-compatible weapons to European allies and a willingness to establish local production and maintenance facilities, South Korea presents Canada with a cost-effective and strategically independent option for its naval modernization efforts.

Additionally, South Korea's Hyundai Heavy Industries (HHI) is positioning itself as a key partner for Poland’s Orka submarine program, offering advanced Air-Independent Propulsion (AIP) submarines with significant technology transfer and industrial cooperation. If selected, HHI’s HDS-2300 or KSS-III PL submarines would not only enhance Poland’s naval capabilities but also enable domestic shipbuilding and maintenance, potentially making Poland an exporter of submarines in the future.

In recent years, Washington has increasingly sought to harness South Korea’s advanced shipbuilding capabilities. In early 2024, Navy Secretary Carlos Del Toro visited South Korea, urging its top shipbuilders to invest in the US, a call that led Hanwha Ocean to acquire a major Philadelphia shipyard, bringing critical expertise and resources. This aligns with the Defense Department’s broader push to strengthen allied industrial partnerships, as outlined in the 2024 Regional Sustainment Framework, which prioritizes deeper cooperation with key partners.

US Defense Department: Regional Sustainment Framework:

Goals:

1. Prevail in Contested Logistics

The DoD will create a resilient, distributed Maintenance, Repair, and Overhaul (MRO) network to sustain operations in peacetime and meet surge demands during crises by expanding partnerships with allies across all domains.2. Enhance Readiness

By aligning sustainment strategies with allied defense priorities, the DoD will strengthen joint capabilities to rapidly restore readiness, counter threats, and deter aggression.3. Strengthen Regional Partnerships

The DoD will foster a collaborative, regional MRO ecosystem to expand repair capacity and enhance co-sustainment across warfighting domains.

South Korean shipbuilding is poised to expand its global influence and reshape the industry. South Korea’s leading shipbuilders, HD Hyundai Heavy Industries and Hanwha Ocean, have joined forces under the “One Team” initiative to strengthen their position in the global naval export market. This partnership, supported by the government, aims to maximize efficiency by dividing responsibilities—HD Hyundai leading surface vessel exports and Hanwha Ocean focusing on submarines—while fostering collaboration and technology sharing. By presenting a unified front in major international competitions like Poland’s Orka Program and Canada’s Patrol Submarine Project, this initiative is expected to enhance South Korea’s competitiveness, drive innovation, and expand its influence in global maritime security.

The recent political developments in both the United States and South Korea have introduced significant uncertainties that may hinder US-Republic of Korea (ROK) collaboration. President Donald Trump's re-election is expected to shift US foreign and security policies towards more transactional relationships, potentially challenging longstanding alliances, including that with South Korea. Concurrently, South Korean President Yoon Suk-yeol's declaration of martial law and subsequent impeachment have led to domestic political turmoil, raising concerns about South Korea's political stability and its impact on international relations. These developments could strain diplomatic ties and complicate joint efforts in addressing regional security challenges, necessitating careful navigation to maintain the strength of the US-ROK alliance

Spoke Story: US Supports Japanese Hypersonic Program

The US State Department has approved a potential $200 million sale to support Japan’s Hyper Velocity Gliding Projectile (HVGP) program, an indigenously developed hypersonic missile designed for island defense and anti-ship operations. Japan has been advancing its hypersonic capabilities amid rising security concerns in the East China Sea and potential threats from China, with plans to deploy the weapon next year. The HVGP program includes multiple variants, with future versions expected to achieve ranges of up to 1,800 miles, reinforcing Japan’s broader counterstrike strategy alongside missile procurements and regional force enhancements.

In 2020, Japan announced the development of its HVGP, a supersonic glide weapon designed to enhance island defense, particularly against potential threats in the East China Sea. The program includes two phases—Block 1 as an early capability and Block 2 with advanced "wave-rider" technology for greater range and precision, including anti-ship capabilities against large targets like aircraft carriers. As Japan moves toward deploying these weapons, potential US-Japan collaboration could help overcome technical challenges, strengthen deterrence, and integrate the HVGP into a broader regional security framework.

The pursuit of counterstrike capabilities has become a key priority for Japan as it reshapes its defense strategy.

Japanese Ministry of Defense: Defense Buildup Program:

Counterstrike capabilities are the Self-Defense Force’s capabilities that leverage standoff defense capability and other capabilities. In cases where armed attack against Japan has occurred, and as part of that attack ballistic missiles and other means have been used, counterstrike capabilities enable Japan to mount effective counterstrikes against the opponent’s territory. Counterstrikes are done as a minimum necessary measure for self-defense and in accordance with the Three Conditions for Use of Force. Operation of this counterstrike capability will be conducted under unified command and control based on joint operations.

Beyond hypersonic capability, Japan is also expanding its strike capabilities with the upgraded Type-12 anti-ship missile, set for deployment this year. This road-mobile system extends its range to over 900 kilometers, up from the original 200 km, and features a reduced radar cross-section and datalink for real-time targeting updates. It is expected to strengthen Japan’s defense posture, particularly across the Ryukyu Islands, where it aims to counter growing Chinese naval activity. To fully leverage its extended range, Japan is also enhancing its intelligence, surveillance, and reconnaissance (ISR) infrastructure while deepening defense cooperation with the United States and South Korea under new security frameworks like Freedom Edge and trilateral intelligence-sharing initiatives.

In addition, Japan plans to deploy long-range missiles on Kyushu by March 2026 as part of its counterstrike strategy. The upgraded Type-12 land-to-ship missile will have the ability to strike North Korea and China’s coastal areas. Unlike hypersonic weapons, the subsonic Type-12 is designed for both anti-ship and land-attack roles, featuring improved stealth and targeting. Potential deployment sites include GSDF garrisons in Yufu, Oita Prefecture, and Kumamoto City, though Okinawa is unlikely due to regional tensions. This deployment strengthens Japan’s defenses in the Nansei island chain, a key area for deterring threats near Taiwan.

Japan’s expanding missile capabilities are crucial to reinforcing its role as the shield in the shield-and-spear alliance framework with the United States, providing a credible deterrent against regional threats. By enhancing its counterstrike and standoff defense capabilities, Japan not only strengthens its own security but also ensures greater stability in the Indo-Pacific, complementing the U.S. military’s forward-deployed posture.

Alliance Insights: Key Articles This Week

Japan:

Nikkei Asia: Japanese frigate Noshiro makes Australian port call amid bidding

Naval News: Japan commissions fourth Awaji-class minesweeper

Nikkei Asia: U.S. Congress studies Japan's fixed submarine production schedule

South Korea:

Australia:

Australian Manufacturing: Austal locks in $200M for US steel shipbuilding expansion

War on the Rocks: When It Comes to Submarines, Australia Is Going to Be Left High and Dry

India:

Technology:

Defense Industrial Base:

The South Korean defence industry is incredibly impressive. It produces a huge number of different platforms - most very modern - on very reasonable budgets. I wish Europe could do the same!